The difference of $500 in the cash discount would be added to the owner’s equity. On the other hand, equity refers to shareholder’s or owner’s equity, which is how much the shareholder or owner has staked into the company. Small business owners typically have a 100% stake in their company, while growing businesses may have an investor and share 20%. Plus, errors are more likely to occur and be loans and grants missed with single-entry accounting, whereas double-entry accounting provides checks and balances that catch clerical errors and fraud. The double-entry practice ensures that the accounting equation always remains balanced, meaning that the left-side value of the equation will always match the right-side value. Revenues and expenses are often reported on the balance sheet as “net income.”

What is the difference between an asset and a liability?

If the net amount is a negative amount, it is referred to as a net loss. The accounting equation sets the foundation of “double-entry” accounting, since it shows a company’s asset purchases and how they were financed (i.e. the off-setting entries). As transactions occur within a business, the amounts of assets, liabilities, and owner’s equity change.

Which of these is most important for your financial advisor to have?

In fact, most businesses don’t rely on single-entry accounting because they need more than what single-entry can provide. Single-entry accounting only shows expenses and sales but doesn’t establish how those transactions work together to determine profitability. The accounting equation is so fundamental to accounting that it’s often the first concept taught in entry-level courses. It offers a quick, no-frills answer to keeping your assets versus liabilities in balance. Accountants and members of a company’s financial team are the primary users of the accounting equation.

The accounting equation And how it stays in balance

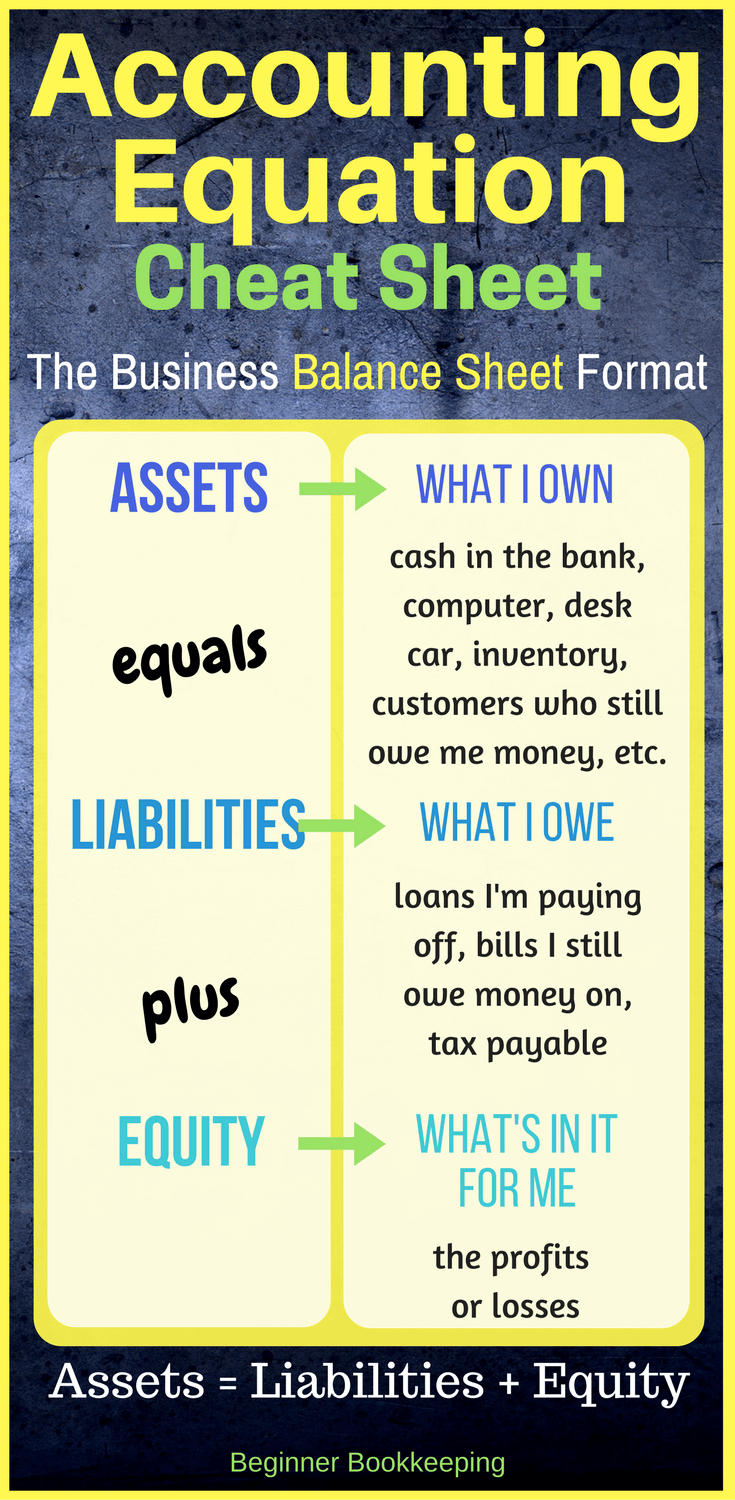

The accounting equation states that total assets is equal to total liabilities plus capital. This lesson presented the basic accounting equation and how it stays equal. All assets owned by a business are acquired with the funds supplied either by creditors or by owner(s). In other words, we can say that the value of assets in a business is always equal to the sum of the value of liabilities and owner’s equity. The total dollar amounts of two sides of accounting equation are always equal because they represent two different views of the same thing. One of the main financial statements (along with the balance sheet, the statement of cash flows, and the statement of stockholders’ equity).

On the other side of the equation, a liability (i.e., accounts payable) is created. This arrangement can be ideal for sole proprietorships (usually unincorporated businesses owned by one person) in which there is no legal distinction between the owner and the business. For example, John Smith may own a landscaping company called John Smith’s Landscaping, where he performs most — if not all — the jobs. Almost all businesses use the double-entry accounting system because, truthfully, single-entry is outdated at this point. For example, if a business signs up for accounting software, it will automatically default to double-entry.

A company’s quarterly and annual reports are basically derived directly from the accounting equations used in bookkeeping practices. These equations, entered in a business’s general ledger, will provide the material that eventually makes up the foundation of a business’s financial statements. This includes expense reports, cash flow and salary and company investments. As expected, the sum of liabilities and equity is equal to $9350, matching the total value of assets.

- Equity represents the portion of company assets that shareholders or partners own.

- The following illustration for Edelweiss Corporation shows a variety of assets that are reported at a total of $895,000.

- This arrangement can be ideal for sole proprietorships (usually unincorporated businesses owned by one person) in which there is no legal distinction between the owner and the business.

Does the stockholders’ equity total mean the business is worth $720,000? For example, although the land cost $125,000, Edelweiss Corporation’s balance sheet does not report its current worth. Similarly, the business may have unrecorded resources, such as a trade secret or a brand name that allows it to earn extraordinary profits. Alternatively, Edelweiss may be facing business risks or pending litigation that could limit its value. Consideration should be given to these important non-financial statement valuation issues if contemplating purchasing an investment in Edelweiss stock. This observation tells us that accounting statements are important in investment and credit decisions, but they are not the sole source of information for making investment and credit decisions.

The term capital includes the capital introduced by the business owner plus or minus any profits or losses made by the business. Profits retained in the business will increase capital and losses will decrease capital. The accounting equation will always balance because the dual aspect of accounting for income and expenses will result in equal increases or decreases to assets or liabilities. The balance sheet is also known as the statement of financial position and it reflects the accounting equation. The balance sheet reports a company’s assets, liabilities, and owner’s (or stockholders’) equity at a specific point in time. Like the accounting equation, it shows that a company’s total amount of assets equals the total amount of liabilities plus owner’s (or stockholders’) equity.

Before explaining what this means and why the accounting equation should always balance, let’s review the meaning of the terms assets, liabilities, and owners’ equity. In the above transaction, Assets increased as a result of the increase in Cash. At the same time, Capital increased due to the owner’s contribution.

The only equity is Sam’s capital (i.e., owner’s equity amounting to $100,000). Net value refers to the umbrella term that a company can keep after paying off all liabilities, also known as its book value. It specifically highlights the amount of ownership that the business owner(s) has. And we find that the numbers balance, meaning Apple accurately reported its transactions and its double-entry system is working. The major and often largest value assets of most companies are that company’s machinery, buildings, and property. These are fixed assets that are usually held for many years.

In this system, every transaction affects at least two accounts. For example, if a company buys a $1,000 piece of equipment on credit, that $1,000 is an increase in liabilities (the company must pay it back) but also an increase in assets. The accounting equation shows how a company’s assets, liabilities, and equity are related and how a change in one results in a change to another. In the basic accounting equation, assets are equal to liabilities plus equity. We could also use the expanded accounting equation to see the effect of reinvested earnings ($419,155), other comprehensive income ($18,370), and treasury stock ($225,674). We could also look to XOM’s income statement to identify the amount of revenues and dividends the company earned and paid out.